TaxMileage - Track Electronically your Business Trip by GPS, produces a Mile Log for IRS Deduction and Expense Reimbursement report

TaxMileage - Track Electronically your Trip by GPS, produces a Mile Log for IRS Deduction and Business Expenses Reimbursement report.

A TaxMileage user saves in average $2,500 every year in mileage expenses reimbursements or for Tax return purposes. For more information: www.taxmileage.com

Why TaxMileage:

•Ease of use cool Free App

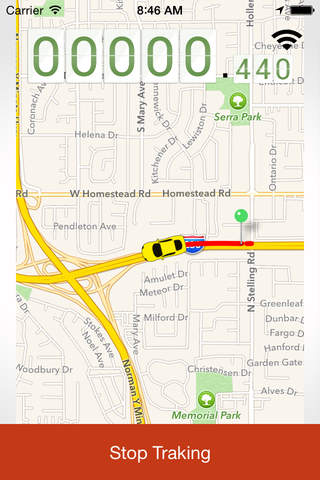

•Live GPS Tracking

•Customize refund rates

•Add or Modify refund sources (Government, Companies)

•Add of Modify refund rates

•Add multiple Vehicles

•Automatically sync with a TaxMileage cloud server

•Add, Modify & Review Trip logs from a regular browser or computer by accessing the taxmileage cloud server at www.taxmileage.com

•Produce comprehensive mile report or logs in a PDF or Excel format.

•Requests the right information to prevent IRS Audits rejections

•Backed by Apps to Simplify LLC.

•Great Customer support

•Award winner of Best app in its category

•Automatically updates the IRS rates every year.

Great Features:

•Live GPS tracking

•Automatically backs up the logs into a cloud server

•Modify, review and monitor trips in real time by accessing the cloud server

•Never loses the trip. A Recover Incomplete Trips functionality helps prevent you from losing Trips as the app will notify you if an incomplete trip is pending.

•Search the database to find a specific log by car, dates, companies, e etc.

•Allows multiple users submitting logs to one central account

•Allows the use of multiple vehicles

•Provides up to date US IRS refund rate automatically for each trip purpose category (Business, Charity, Moving, Medical)

•Allows users to produce a custom trip purpose and refund rate.

Designed for:

•Citizens, employees and companies looking to receive an IRS tax credit for vehicle mileages.

•Citizens and companies that uses its Vehicle for business, charity, moving and medical purposes.

•Employees that needs to produce mileage logs for refund purposes.

•Realtors

•Salesperson

•Accounting, Delivery Professionals, Small Business

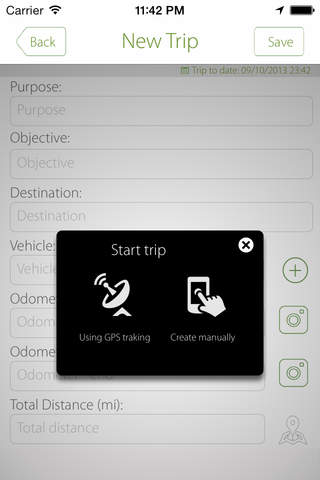

How TaxMileage Works:

A TaxMileage solution is the most ease of use application to help you record and generate a mileage reimbursement report. The solution brings you the ability to activate the automatic mode during a trip, so the smartphone GPS does all the work for you. While you travel on automatic mode, the smartphone is recording the GPS points and time until you arrive at your destination. Once you reach your final destination, the app sends your trip data to the TaxMileage server. As a result, you will have a comprehensive and undisputed mileage reimbursement report that you can access from any device, anywhere at any time.

Key Words: Miles, Mileage, Kilometers, Track, IRS, Deduction, Expenses, Reports, Reimbursement, Tax, Taxes, GPS, Finances, business, Realtors, Accounting, Mile Log, MileTracker, MileageTrace, MileageTracker. Tax mileage records, logbook, International, business, logging,

reimburse.

Why Customers selected TaxMileage:

1. The solution uses the app to log the trip data and synchronizes the data with the TaxMileage server. The server can be access from any device, anywhere at any time using a browser.

2. The Server brings you the ability to review and modify you trip data and generate a comprehensive report.

4. The apps brings you an automatic mode, so you will have access to an undisputed report showing exactly where you were during the trip by login in GPS information automatically.

5. Users who are unfortunate to lose their phone, have nothing to worry about. All logged trip information’s are safely storage in our server.

6. Users do not have to periodically back up its IPhone or reports. The TaxMileage server will offer you access to your current and old reports.

7. The application allows multiple users to use the same vehicle and centrally log their trip in the same report.

*Continued use of GPS running in the background can dramatically decrease battery life.